Borrowed Car

If you use a borrowed car, are you insured if you have an accident? Yes…and no!

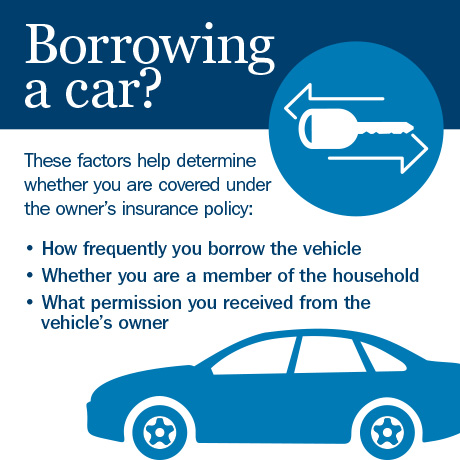

We have all had times when we have needed to borrow a car from a relative or friend or neighbor. Or maybe used a loaner provided by a repair shop. In most states, insurance coverage follows the vehicle. In a nutshell, when you borrow a car, you are borrowing the owner’s auto insurance policy too. But if you use the borrowed vehicle too often, this could be construed as “regular useâ€, and any insurance claim payments could be denied if you have an accident.

We have all had times when we have needed to borrow a car from a relative or friend or neighbor. Or maybe used a loaner provided by a repair shop. In most states, insurance coverage follows the vehicle. In a nutshell, when you borrow a car, you are borrowing the owner’s auto insurance policy too. But if you use the borrowed vehicle too often, this could be construed as “regular useâ€, and any insurance claim payments could be denied if you have an accident.

What is “regular use?â€

Regular use can be using the same vehicle too much in a short period of time. Or it can be a random and recurring pattern of use over a long period of time.

Regular use examples include:

- If you have a company car at your disposal, this would qualify as regular use. You will not be able to apply your personal auto policy or the policy of anyone else in your household if you have an accident.

- If you use the vehicle of a friend or neighbor or non-household relative once a week or a couple of times a month over a period of years, this could be “regular use.â€

Non-regular use is okay

Non-regular use is okay

If you use a car to go away for a weekend with the owner’s permission, that’s not a problem. If you borrow the car to go to the grocery store every week for a year, that could be a problem; insurance coverage could be denied.

Solution: Special Endorsement

It is called “Use of Other Auto Endorsement.†It allows the removal of the “regular use†exclusion. You gain the protection and security of your own auto policy coverage even though you use a non-owned vehicle “too much!â€

If you are interested in this endorsement or have questions about other issues (and there are some) concerning the borrowing and lending of cars, contact us here.